Data 311: Machine Learning

Lecture 16: Ridge Regression and LASSO

University of British Columbia Okanagan

Recall: Linear Model

Recall the linear model:

\[ Y = \beta_0 + \beta_1 X_1 + ··· + \beta_p X_p + \epsilon \]

In ordinary least squares regression, estimates of the regression coefficients (i.e. the \(\beta\)s) are found by minimizing the residuals sum of squares (RSS) (this as our “cost” function)

\[RSS = \sum_{i=1}^n (y_i - \hat y_i)^2\]

Recap

We’ve now seen a couple of alternatives to the linear model for regression.

BUT, the linear model still reigns supreme in most realms of science due to its simplicity (which helps for inference).

We can improve upon the linear model (both in terms of prediction accuracy and model interpretibility) by replacing ordinary least squares fitting with some alternative fitting procedures: shrinkage (aka regularization) methods.

Motivation

Prediction Accuracy

- It’s becoming more and more common that \(p > n\)

- In those scenarios there is no longer a unique least squares coefficient estimate and the model has higher variance.

Model Interpretability

- By removing irrelevant predictors — or setting the corresponding coefficient estimates to zero — we can obtain a model that is more easily interpreted.

Non-unique solutions

Think about fitting a OLS line to a single observation.

Non-unique solutions

Think about fitting a OLS line to a single observation.

- This line has a 0 SSR

Non-unique solutions

Think about fitting a OLS line to a single observation.

- This line has a 0 SSR

- As does this one

Non-unique solutions

Think about fitting a OLS line to a single observation.

- This line has a 0 SSR

- As does this one

- As does this one

High Variance

Think about fitting a OLS line to two data points

- This line has a 0 SSR

- It has high variance

- And low bias

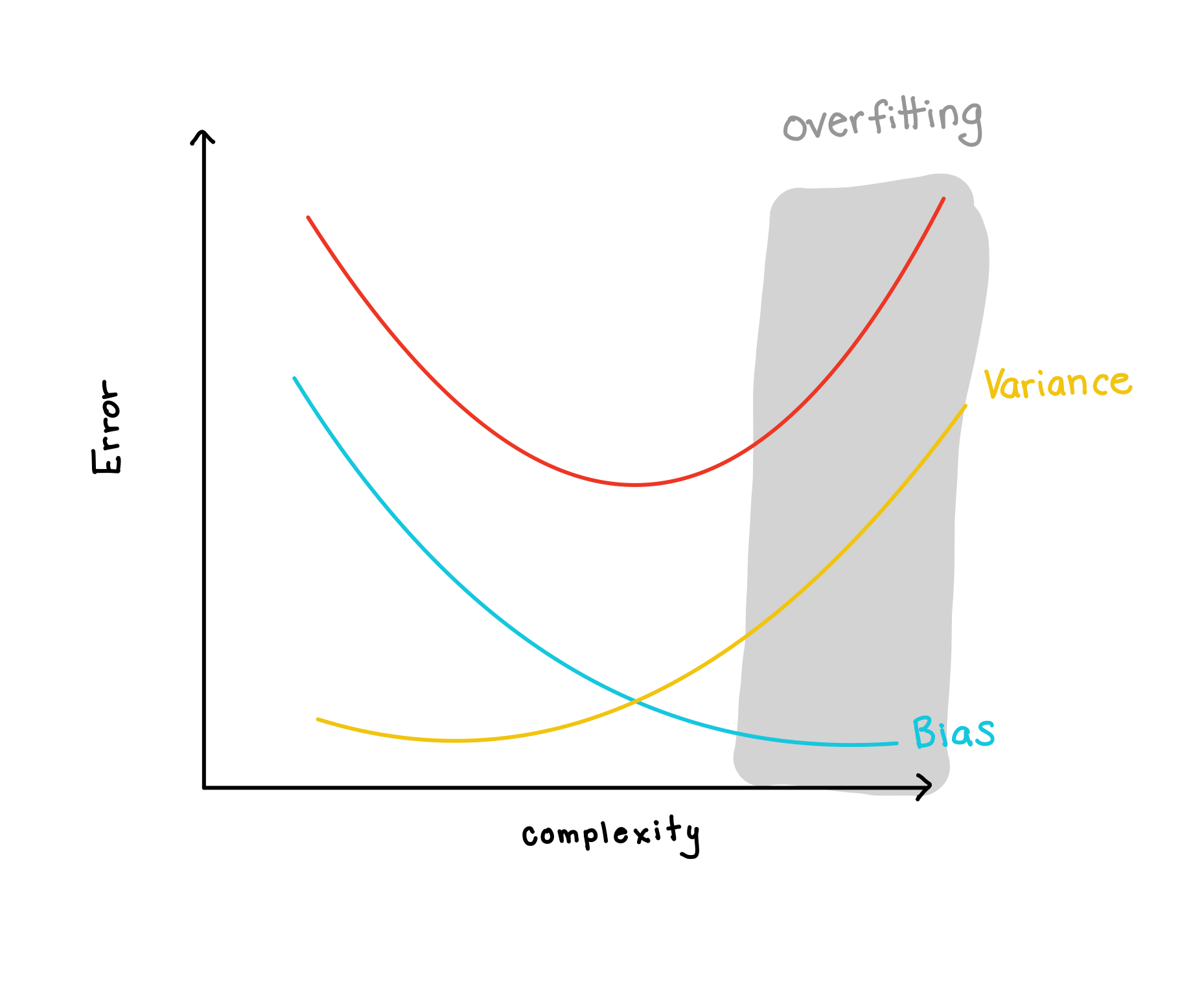

Bias-Variance Tradeoff

If n, the number of training observations, is much larger than p, the number of predictors, there can be a lot of variability in the least squares fit, resulting in overfitting and consequently poor predictions on future observations not used in model training.

Combatting High Variance

Instead of least squares, we will consider an alternative fitting procedure that will introduce a small amount of bias to get back a significant drop in variance (thereby improving prediction accuracy).

Variable Selection

To combat this, we could use subset selection1 wherein only a subset of the \(p\) predictors that we believe to be related to the response are used to fit the model (see Ch 6.1 in ISLR)

Using cross-validated prediction error, for example, we could select a single best model from all possible models.

For large \(p\), however, an exhaustive search of every possible subset of predictors is not computationally feasible2; furthermore it will be liable to overfit to the data.

Ridge Regression

Ridge regression (RR) includes a penalty in the estimation process and aims to minimize:

\[\begin{gather} RSS + \lambda \sum_{j=1}^p \beta_j^2 = \sum_{i=1}^n ( y_i - \hat y_i)^2 + \lambda \sum_{j=1}^p \beta_j^2\\ = \sum_{i=1}^n (y_i - \beta_0 - \sum_{j=1}^p \beta_j x_{ij})^2+ \lambda \sum_{j=1}^p \beta_j^2 \end{gather}\] where \(\lambda \geq 0\) is a tuning parameter that shrinks the \(\beta_j\) estimates towards 0.

Shrinkage penalty

- \(\lambda \sum_{j=1}^p \beta_j^2\) is the shrinkage penalty that will penalize the model for the total “size” of the coefficients1

- The penalty will be small when \(\beta_1, \dots \beta_p\) are close to zero

As \(\lambda\) increases the coefficient estimates will tend to “shrink” towards 0.

Hence minimizing \(RSS + \lambda \sum_{j=1}^p \beta_j^2\) will encourage smaller (in magnitude) values for \(\beta_j\)

Example: Credit

The Credit dataset contains information about credit card card holders and includes 11 variables including:

-

Balancethe average credit card debt for each individual (response) and several quantitative predictors:-

Age,Cards(number of credit cards),Education(years of education),Income(in thousands of dollars),Limit(credit limit), andRating(credit rating).

-

Fitting a least squares regression model to this data, we get…

MLR Credit fit

...

Estimate Std. Error t value Pr(>|t|)

(Intercept) -479.20787 35.77394 -13.395 < 2e-16 ***

Income -7.80310 0.23423 -33.314 < 2e-16 ***

Limit 0.19091 0.03278 5.824 1.21e-08 ***

Rating 1.13653 0.49089 2.315 0.0211 *

Cards 17.72448 4.34103 4.083 5.40e-05 ***

Age -0.61391 0.29399 -2.088 0.0374 *

Education -1.09886 1.59795 -0.688 0.4921

OwnYes -10.65325 9.91400 -1.075 0.2832

StudentYes 425.74736 16.72258 25.459 < 2e-16 ***

MarriedYes -8.53390 10.36287 -0.824 0.4107

RegionSouth 10.10703 12.20992 0.828 0.4083

RegionWest 16.80418 14.11906 1.190 0.2347

---

...With an Adjusted \(R^2\) of 0.9538.

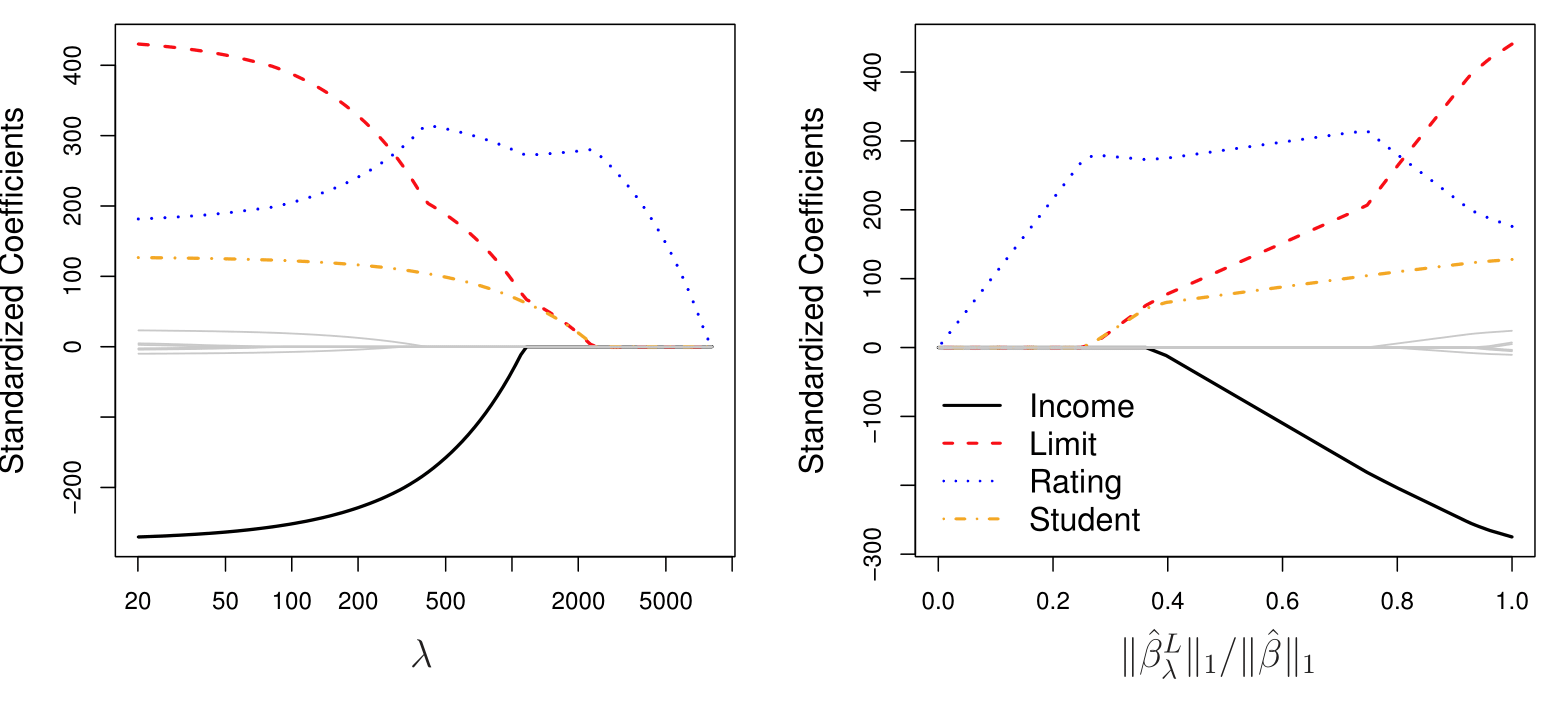

Ridge Regression Coefficients

Unlike least squares, ridge regression will produce a different set of coefficient estimates, \(\beta^R_\lambda\), for each value of \(\lambda\)

ISLR Fig 6.4: The standardized ridge regression coefficients are displayed for the Credit data set, as a function of \(\lambda\) and standardized \(\ell_2\) norm.

A note about norms

Another way we could have presented the penalty is through the norms. The p-norm (or \(\ell_p\) norm) is defined as:

\[ || x ||_p = \left(\sum_i |x_i|^p\right)^{1/p} \]

The 2-norm is Euclidean distance, \(|| x ||_2 = \sqrt{\left(\sum_i x_i^2\right)} = \sqrt{x_1^2 + x_2^2 + \ldots + x_i^2}\), and the Manhattan distance is the 1-norm (aka L1 norm): \(|| x ||_1 = \sum_i |x_i| = |x_1| + |x_2| + \ldots + |x_i|\)

L2 Regularization

The squared L2 norm in used in the Ridge Regression penalty:

\[ \lambda || \beta ||_2^2 = \lambda \sqrt{ \beta_1^2 + \beta_2^2 + \ldots + \beta_p^2 }^2 = \lambda\sum_{i=1}^p \beta_i^2 \]

This process of adding a norm to our cost function is known as regularization.

Hence this Ridge Regression is also known as L2 regularization.

Tuning Parameter

Clearly our choice for \(\lambda\) will be an important one (can you guess how we will find it?)

If \(\lambda=0\) then the estimation process is simply least squares.

As \(\lambda\) increases, the flexibility of the ridge regression fit decreases, leading to decreased variance but increased bias.

As \(\lambda \rightarrow \infty\) then the penalty grows and the coefficients approach (but never equal) 0; this corresponds to the null model that contains no predictors.

ISLR simulation

A simulated data set containing \(p = 45\) predictors and \(n = 50\) observations.

ILSR 6.5 Squared bias (black), variance (green), and test mean squared error (purple) for the ridge regression predictions on a simulated data set, as a function of \(\lambda\) (left) and the standardize \(\ell_2\) norm (right). The horizontal dashed lines indicate the minimum possible MSE. The purple crosses indicate the models for which the MSE is smallest.

Scaling of predictors

-

Least squares coefficients are scale equivariant

- i.e. multiplying \(X_j\) by a constant \(c\) leads to a scaling of the least squares coefficient estimates by a factor of \(1/c\).

-

In contrast, the ridge regression coefficient estimates can change substantially when multiplying a given predictor by a constant

- Why? since we use the sum of squared coefficients in the penalty term of the ridge regression objective function.

Scaling of predictors (cont’d)

- Therefore, it is best to apply ridge regression after standardizing the predictors, using the formula

- Software will peform centering and standardizing by default and reports answers back on original scale.

Comment

- Unlike subset selection, which will generally select models that involve just a subset of the variables, ridge regression will include all predictors in the final model.

- In other words, \(\beta\) coefficients approach 0 but never are actually equal to zero.

- But adopting a small change on our penalty term, we will be able shrink coefficients exactly to zero (and hence perform feature selection) \(\dots\)

Lasso

The least absolute shrinkage and selection operator or LASSO is arguably the most popular modern method applied to linear models.

It is quite similar to ridge regression only now it minimizes \[\begin{align*} RSS + \lambda \sum_{j=1}^p |\beta_j| \end{align*}\]

Important advantage: it will force some coefficients to 0 (whereas RR will only force them “close” to 0)

L1 regularization

Another way that you might see this model being presented is using the L1 norm; in other words, the LASSO uses the \(\ell_1\) penalty:

\[ \begin{align} \lambda || \beta ||_1 &= \lambda\left( | \beta_1 | + | \beta_2 | + \ldots + | \beta_p | \right)\\ &= \lambda\sum_{i=1}^p | \beta_i | \end{align} \]

Hence this method is also referred to as L1 regularization.

LASSO Coefficients

Unlike least squares, ridge regression will produce a different set of coefficient estimates, \(\beta^R_\lambda\), for each value of \(\lambda\)

ILSR FIg 6.6: The standardized lasso coefficients on the Credit data set are shown as a function of \(\lambda\) and standardized \(\ell_2\) norm.

Benefits of LASSO

It is worth repeating that the \(\ell_1\) penalty forces some of the coefficient estimates to be exactly equal to zero when the tuning parameter \(\lambda\) is sufficiently large

Hence the lasso performs variable selection

As a result, models generated from the lasso are generally much easier to interpret than those of ridge regression

We say that the lasso yields “sparse” models — that is, sparse models that involve only a subset of the variables.

Benefits of Ridge Regression

The lasso implicitly assumes that a number of the coefficients truly equal zero

When this is not the case, i.e. all predictors are useful, Ridge Regression would leads to better prediction accuracy

These two examples illustrate that neither ridge regression nor the lasso will universally dominate the other.

The choice between Ridge Regression and LASSO can also boil down to the Prediction vs. Inference trade off (aka Accuracy-Interpretability trade off);

When to use what?

One might expect the lasso to perform better in a setting where a relatively small number of predictors have substantial coefficients, and the remaining predictors have coefficients that are very small or that equal zero

Ridge regression will perform better when the response is a function of many predictors, all with coefficients of roughly equal size.

Since we do not typically know this, a technique such as cross-validation can be used in order to determine which approach is better on a particular data set.

When to use Regularization

\(p > n\)

These methods are most suitable when \(p > n\).

Even when \(p < n\) these approaches (especially lasso) is popular with large data sets to fit a linear regression model and perform variable selection simultaneously.

Being able to find, so-called “sparse” (as opposed to “dense”) models that select a small number of predictive variables in high-dimensional datasets is tremendously important/useful.

When to use Regularization

Multicollinearity

Less obviously, when you have multicollinearity1 in your data, the least squares estimates have high variance.

Furthermore, multicollinearity makes it difficult to distinguish which which variables (if any) are truly useful.

Using the same argument as before, we can use ridge regression and lasso to reduce the variance and improve prediction accuracy and simultaneous shrink the coefficients of redundant predictors.

Multicollinearity in Credit

Choosing \(\lambda\)

Both the lasso and ridge regression require specification of \(\lambda\)

In fact, for each value of \(\lambda\) we will see different coefficients.

So how do we find the best one?

The answer, as you may have guessed, is cross-validation.

glmnet

To perform regression with regularization we use the function glmnet function (from package glmnet )

Note that

glmnetdoes not allow the formula argument.Hence we will need specify

xandy.

N.B. there is a handy helper function model.matrix() that will help us do this.

glmnet penalty

The penalty used is: \[ \frac{(1-\alpha)}{2} || \beta ||_2^2 + \alpha ||\beta||_1 \]

alpha=1 is the lasso penalty \(||\beta||_1\) (default)alpha=0 is the ridge penalty

Values between 0 and 1 are allowed and correspond to elasticnet (this model is not discuss here or in the book).

glmnet \(\lambda\)

A grid of values for the regularization parameter \(\lambda\) is considered

nlambdais the number of \(\lambda\) values considered in the grid (the default is 100)The actually values are determined by

nlambdaandlambda.min.ratio(see the help file for more on this)Alternatively, the user may supply a sequence for \(\lambda\) (in the optional

lambdaargument), but this is not recommended.

glmnet standardizing and family

By default the function standardizes the data1

Cross-validation

In order to determine the best choice for \(\lambda\) we use cross-validation

The

cv.glmnetfunction from the same package will perform \(k\)-fold cross-validation forglmnet(default is 10-fold)From that we produce a plot that returns good value(s) for \(\lambda\).

helper function

The model.matrix() function is particularly useful for creating x; not only does it produce a matrix corresponding to the predictors but it also automatically transforms any qualitative variables into dummy variables1

Lasso with Credit

Lasso Coefficient Estimates

To see the values for the coefficient estimates use coef(). For example to the see coefficients produced when \(\lambda\) the 60th value in our sequence ( log \(\lambda\) = 0.4938434 in this case):

Ridge Regression with Credit

Cross-validation for RR

set.seed(10) # use cross-validation to choose the tuning parameter

cv.out.rr <- cv.glmnet(x, y, alpha = 0)

plot(cv.out.rr); log(bestlam <- cv.out.rr$lambda.min)[1] 3.680249

Cross-validation for Lasso

set.seed(1) # use cross-validation to choose the tuning parameter

cv.out.lasso <- cv.glmnet(x, y, alpha = 1)

plot(cv.out.lasso); log(bestlam <- cv.out.lasso$lambda.min)[1] -0.5295277

CV output plot

The cv.glmnet ouptut plot produced from a simulation that you will see in lab

Beer

...

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 3.7174521 0.6807382 5.461 8.56e-07 ***

qlty -0.0111435 0.0064446 -1.729 0.0887 .

cal -0.0055034 0.0089957 -0.612 0.5429

alc 0.0764520 0.1752318 0.436 0.6641

bitter 0.0677117 0.0153219 4.419 3.98e-05 ***

malty 0.0002832 0.0099639 0.028 0.9774

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.8661 on 63 degrees of freedom

Multiple R-squared: 0.6678, Adjusted R-squared: 0.6415

F-statistic: 25.33 on 5 and 63 DF, p-value: 6.588e-14

...Lasso on beer

Best \(\lambda\) for LASSO

Lasso on beer

Lasso on beer

Lasso on beer

Coefficients

cbind(coef(beer.lm), # OLS (least squares estimates)

# LASSO estimates ...

coef(lasso, s = bestlam.lasso), # ... at best lambda

coef(lasso, s = lambda2)) # ... at lambba within 1 s.e.6 x 3 sparse Matrix of class "dgCMatrix"

s1 s1

(Intercept) 3.7174521392 3.334440257 3.25063467

qlty -0.0111434572 -0.008782345 .

cal -0.0055034319 . .

alc 0.0764519623 . .

bitter 0.0677117274 0.062008057 0.04831986

malty 0.0002831604 . . Summary

-

Ridge regression and LASSO works best in situations where the least squares estimates have high variance.

This can happen when \(p\) exceeds (or is close to \(n\))

It can also happen when we have multicollinearity

LASSO shrinks coefficient estimates to exactly 0 hence it can be viewed as a variable selection technique

Ridge Regression shrinks coefficient estimates close to 0 so it never actually eliminates any predictors.

Different Formulation

The coefficient estimates can be reformulated to solving the following two problems.

Lasso regression solve:

\[ \text{minimize} \quad \sum_{i=1}^{n} \left(y_i - \beta_0 - \sum_{j=1}^{p} \beta_j x_{ij}\right)^2 \quad \text{subject to} \quad \sum_{j=1}^{p} |\beta_j| \leq s \]

Ridge regression solves:

\[ \text{minimize} \quad \sum_{i=1}^{n} \left(y_i - \beta_0 - \sum_{j=1}^{p} \beta_j x_{ij}\right)^2 \quad \text{subject to} \quad \sum_{j=1}^{p} \beta_j^2 \leq s \]

Contours of the error and constraint functions for the lasso (left) and ridge regression (right). The solid blue areas are the constraint regions, \(|\beta_1| + |\beta_2| \leq s\) and \(\beta_1^2 + \beta_2^2 \leq s\), while the red ellipses are the contours of the RSS.